skip to main |

skip to sidebar

- The counterpoint is positive seasonality.

- Again, this week is loaded with big news items. Should prove interesting including possible multiple whips in either direction!

- PS....there have been multiple posts over the past few days because I believe we're approaching an inflection point and alot of news seems to be peaking at right about the same time. Interesting how that tends to happen near inflection points.

- Good luck!

- Oh yeah, to Americans....VOTE...Remember in November!!!

- AND...Vote smart! Do the right thing for our kids and grandkids.

- That is THE question for this and following election cycles.

- As the election approaches, my humble opinion remains that the Federal Government's responsibilities are few and detailed in the U.S. Constitution! Nothing is stopping individual states from entering grand social experiments...yet none do.

- Why is that? Perhaps it's because they know it will bankrupt them! So, why do we permit the over reach by the Federal government? Is it because they're not limited by a balanced budget concept and can print money freely out of thin air via deficit spending? Sound like a free lunch to you? We all know there is no such thing as a "free lunch".

- Instead, the states should be free to govern themselves under the umbrella of Federalism since they are ultimately closer to accountability of the people. Wasn't that the intent of the Founding Fathers? Government is best which governs least?

- In America, government is supposed to be accountable to the people vice the people being told what to do by the government! Isn't that why our ancestry entered a Revolution against the most powerful nation in the world? Isn't that what they were willing to sacrifice all for? Self determination...it was a revolutionary concept that only America could rise to...and then actually maintain. That is our history in a nutshell.

- I fear that we have forgotten what makes America special. Hell...look all across current socialist Europe right now. They are a mess and pulling back from Socialism as fast as they can! Because it succeeded or is it failing? Why else would they be cutting their socialist programs despite riots in the streets? C'mon think about it...please! Wake up America....time is growing short.

- Yet, the U.S. has plunged head forward into expanding socialism despite the evidence that it is ultimately destructive. Does this make any sense at all?

- In my humble opinion...the US Constitution details that the Federal Government has responsibilities in the following key areas:

- 1) Enforcing the Bill of Rights which protect individual citizens against a far reaching "We know better than you" government! Currently failing...for example: 1) seizure of private property by government (Kelo vs New London), 2) repeated assaults against 2nd Amendment rights of citizens to possess firearms, 3) continual affront against freedom of religion (displays of Christianity in the public square while encouraging Muslim studies in public schools...Huh?). Believe me...I could go on.

- 2) Providing for common defense...currently failing. This includes ILLEGAL immigration (as opposed to LEGAL immigration) and, of course, violent and forceful invasion by a foreign power.

- 3) Enforcing Contract Law...currently failing. Examples include: 1) TARP / bank bailouts at the expense of taxpayers, 2) auto company bailouts..equity shareholders should've been wiped out, bondholders should've been crammed down into equity holdings and unions should've had no say in the process. Also, banks shouldn't be permitted to foreclose on people without due process of law, which is becoming a mockery, for convenience and for politicians to maintain campaign contributions from the banking community.

- 4) Protection of individual property rights...previously mentioned...Kelo vs New London and foreclosures on homes without due process.

- 5) Free speech protections...currently failing. The Patriot Act has been expanded under the current administration to include surveillance of domestic entities vice being repealed in totality as they campaigned on. Why could that be? Hmmmm.....

- 6) Deficit spending is destructive and, eventually, enslavement of future generations due to the failures of their fathers (ie, us) to do the right thing. Yes, I said it! Future generations are being turned into debt slaves to the Federal government and the special interests that are in control of the current crop of politicians. Is there any other way to perceive what is occurring?

- Sorry for the rant but....

- Remember in November!!!

- Think the market is waiting for the election and the Federal Reserve Meeting?

- Naaah! That's just silly.

- Cartoon at the bottom...must be just how Bernanke feels. I think he has gotten himself into a trap.

- Consider two possibilities regarding QE2 and the economy....

- 1) Fed commences with QE2...the extra money just winds up in the commodity markets which shoots prices up even further (including oil, gas and foodstuffs) for the end user. This pinches consumers / businesses even further and tips us back into recession. Remember, $150 barrel of oil and $4.50 gallon of gas???

- 2) Fed commences with QE2...the extra money goes nowhere, has no impact (just like QE1) and you get another trillion dollars of debt on the Fed's balance sheet. What? Don't even get a t-shirt out of the deal?

- Regarding QE2 and the stock market's reaction...very possible that all good news is priced in and the announcement, post-election to boot, may turn into a "buy the rumor, sell the fact" event. We'll see!

- Just a reminder, everything the Federal Reserve is doing is an experiment. Got that? An experiment based upon Bernanke's thesis from the early 2000's. He seems pretty confident it will work. I think he's already proven that it won't!!! Since QE1 failed, why double down on QE2? When a car is stuck in the mud, more gas equals deeper in the mud. Do something different? (Hit link for 1922 Depression below).

- Although, Chairman Bernanke wants you to believe in his presumed magical powers...NO ONE, not one single person including Bernanke himself, knows how any of this is going to turn out!

- Thus, I would like to put forward a simple thought for consideration by average investors attempting to tangle with current markets...this IS NOT an ordinary business cycle recession that you experienced throughout your investment life (tapping the gas pedal...lower rates, etc...works for those). Instead, it is a credit deleveraging recession (jamming the gas pedal down just makes it worse...longer and harder to get out of it). This type of economic environment (ie, U.S. 1922 and 1930's) requires time and clearing bad debts out of the system through servicing them or defaulting on them through bankruptcy. The frightening thing is Japan has been mired in a similar mess since 1989...that's right kiddies...20 years and still stuck in the mud since they have yet to stop hiding the bad bank debts and, instead, recognize and clear the debts. While working through this process, history indicates that market volatility will be higher and more frequent recessions will occur.

- Psst...to the President, Congress and Federal Reserve....piling more debt into a system that is actually trying to delever from debt is counter productive. That will only PROLONG the economy's low and slow performance and result in higher deficits. So, knock it off! Let's get to the "recognition and deal with it" phase and get this over with now! Sure, it will be painful. The only part we control is how long do you want the pain to last? Face it and deal with it and it will be harsh but over quickly like the 1922 Depression. Continue on our government's current choice of "delay and pray" and, instead, get a repeat of the Great Depression of the 1930's which we only escaped through a war (not necessarily a good idea).

- Those are the simple facts which can be found through study of financial history. It is what it is!

- Doesn't mean that you can't place some trades...I just believe that it's always best to be aware of the environment you are in when you make your choices. This is not a buy and hold environment. More like "choose wisely, make it, take it, and scamper off to safety...repeat."

- Good luck!

- Vote for those that have sworn and upheld or swear to uphold the Constitution of the United States of America!

- All others should be dismissed / voted out.

- Our kids and grandkids deserve nothing less! We are responsible for the future we give to them.

- And, yes, it will require sacrifice on the part of us adults. So, brace yourselves and do the right thing.

- Yes, it is that straight forward. It may not be easy but it must be done.

- Are you strong enough to make the tough choices laid before you?

- Look at your children and think of your grandchildren tonight before you rest.

- It's important!

- You've all heard of POMO, the Federal Reserves Permanent Open Market Operations, recently.

- Above is a great graphic which demonstrates the correlation between POMO days and stock market performance over the past two months.

- Correlation or causation is the question? Can't prove causation but...

- It sure looks as if the government has bought themselves a stock market rally.

- What do you think?

- Artificial market. How do you invest in what may turn out to be a mirage?

- 'Nuff said....Good luck!

- Simply put...if you own US based bond funds, you are at risk.

- Yield can go lower, but not much lower. The capital loss risk for the interest yield is absurd. Especially, if the FED is telling you they want 2% inflation....why the hell are you going to loan the US Government money for 10 years at 2.5% interest when the goal is 2% inflation?

- Bernanke has created a trap. There are no safe instruments.

- Honestly, I have no clue where things are headed but bond funds are in a tough spot to deliver further here.

- Frankly, I hope the Federal Reserve fails and we get some deflation. Not wild deflation but a mild deflation would actually do more good for the economy longer term.

- Just my opinion.

- This very simple and pointed 32 second question during recent Congressional Hearings on the Massive Mortgage Mess completely captures the entire essence of the current situation.

- It's basically between: 1) the rule of law or 2) save the banks at any and all costs.

- Rule of law should win hands down!

- Banks are a business. Period! As such, it is in the bank's interest to conduct it's business wisely under sound, prudent and legal principles. To do otherwise would, reasonably, result in the failure of the business / bank. Businesses fail all the time and go to bankruptcy court to settle...so what? Debts are settled and cleared out of the system. Done...move right along...nothing to see here folks.

- Let the bad bank fail and a better one will probably arrive on scene if there is demand for the service...capitalism.

- No bailouts for banks! How many restaurant or sporting goods stores have you ever seen bailed out? None! Because, like banks, they are like the old Lay's Potato Chip commercials..."Go ahead. We'll make more."

- Banks which made bad (and sloppy) loans to people who the banks knew couldn't possibly pay the loan back should fail. And, people who took out loans they knew they couldn't reasonably pay back should be foreclosed upon under due legal process.

- As long as the Federal Reserve and CONgress continue to save the banks (ahem...campaign contributers) at any and all costs, the debts will never be cleared and it will take years for the conclusion of this depressed economy.

- Don't believe me? Look at the mess Japan has been in since 1989. They did what Ben Bernanke is trying now. He just thinks that he's smarter than them.

- God Bless us all!

- Government reported CPI at the close of August showed 1.1% inflation (Psst...remember that the Federal Reserve has said they want this to double to 2%). Yet the picture above shows the year over year change in prices for many commodities. Do you want to see those commodities double too? From their already pumped up prices?

- The Federal Reserve has been pumping a lot of money into the system. Only, it's not going into improvement of the economy and job creation. It's hot money going into speculative trading. Is the Fed creating more bubbles through easy money? And at what cost to the average person? There is no free lunch.

- And if manufacturing has to pay these increased prices yet can't pass the price increases on to customers due to low demand...what does that do to their earnings?

- This crap has got to stop...before it catches up to us regular folks at the supermarket.

- POMO money stopped the market from falling and brought it back to flat on the day.

- POMO day today! Da Boyz get more cash to hold the market up? Are they holding it up for the elections? The 3 NOV FED meeting where they may announce QE2? Market seems to be priced for perfection. Makes me nervous.

- Interesting how this latest move looks like the FEB-APR move earlier this year. All up with no pullbacks.

- Price above moving average guides but stretched. There's not much to say since nothing has changed.

- Remember Martha Stewart's great transgression? She owned ImClone stock back in 2004 and sold on some insider information which helped her to net $277,000 on that trade.

- Then, she was charged by the Securities Exchange Commission (SEC) and eventually fined $30,000 and got 5 months of jail time.

- Dayum! Darned good thing they got her...Martha Stewart....Destroyer of Worlds!!! Now let's compare....

- Look at what happened a week ago. Angelo Mozillo, former CEO of the now spectacularly bankrupt mortgage mill known as Countrywide, was hauled before the SEC. But first...while at Countrywide he made about $100 million a year by initiating piles and piles of crappy mortgages (many of which are now at Fannie Mae and Freddie Mac...which means you and I are backing those stinky mortagage turds via our tax dollars! Nice, huh? Oh yeah, Bank of America is regretting ever taking this pile of crap on to their team. Snookered?)

- OK, OK...so the SEC's got him! And what happens???

- While he states that there was no wrongdoing on his part, he agrees to pay a fine of ~$68 million....no time to be spent at the grey bar motel.

- Got that?

- Does any of it make sense?

- Sheesh...if tar, feathers, a rail and the outskirts of town were ever appropriate...this would be the textbook case! My opinion of course.

- Welcome to Amerika, Comrade. It is who you know that matters in these trifling matters of justice.

- May the Oligarchs rule until our porridge runs out!!! FEAST, FEAST....PORRIDGE FOR ALL!!!

- Great news! The Obama Administration has finally created a job! Bagdad Bob has found work at Fannie Mae / Freddie Mac as their Spokesperson.

- Things are really turning around!

- Huh? What? A down day? Someone call the FED!

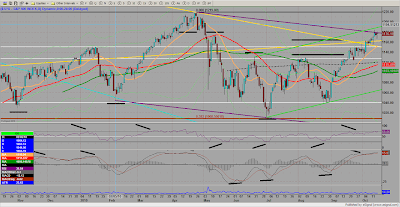

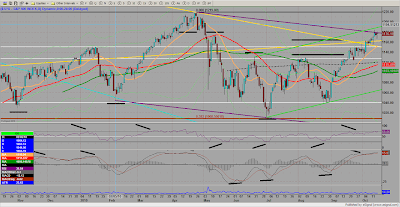

- The purple and green trend channels having an influence here?

- RSI and MACD rolling over. NYSI rolling over as well. Might be some downside or corrective ahead. Tops, in the past have taken a few days.

- Still just trading...Wednesday and Friday are more POMO days (Tuesday wasn't and went down...dey need the crack hit) and they still do have an effect so I've got to respect that.

- Lately, banks have been getting hit hard. Probably due to the massive mortgage mess which is going to take time to sort out.

- But, alas, not to worry because we all know how the game is played...

- OK...is it live or is it Memorex?

- Above is a chart of the SPY which is the ETF that tracks the SP500...it shows normal trading hours which close at 4PM.

- At precisely 4:15 EST, as the after hours market was closing, it flash crashed down to 106.4 (SP 1064)...down 10% in 15 minutes. On the chart above I highlighted it via the horizontal black line.

- Oddly, it coincides with the green uptrend channel highlighted in yesterday's SP500 chart....take a look at it and you'll see what I'm talking about.

- I guess those trades will get cancelled. But, it's insane that this happens at all.

- Another reason why you can't trust this market...or maybe I just can't trust it.

- IBM and Apple getting crunched in after hours...but, of course, that can all change by the morning. Who knows?

- Good luck.

- Still overbought...holding highs.

- Interesting...drew a purple channel possibility as bear possibility. But, who the heck knows. This recent move has been as confounding as the MAR-APR move. We're past Options Expiration week, approaching the elections, it has been held up pretty well, and the Feds continue to pump POMO and threaten QE2. Who the heck knows.

- I don't! My MA guides indicate up but the market has little ebb and flow. Just not my type of market I guess. Happens some times.

- Sentiment is getting stretched bullish with price increases.

- Apple reports earnings after Monday's close and it is a huge segment of the NASDAQ 100. I'll be watching the reaction in the following days.

- Again...personally, I can't buy it here....just me. And I don't believe that the economy is turning. Tough situation...testing everyone's beliefs. Those that have ridden this move from the lows...hat tip to you.

- Intraday trading has been the only way for me to play...it continues.

- Good luck!

- And now to something completely different...the world's scariest job?

- Federal Reserve Chairman Bernanke in a speech this morning just said that inflation is too low and that the Federal Reserve is now committed to create a higher inflation level. WHAT??? When have you ever heard that in your lifetime. Geez....you'd think gas was 37 cents a gallon...not.

- Unemployment continues to rise and more folks are rolling off the extended benefits. How will those folks be able to pay for more inflation?

- Housing market is freezing up because of the title paperwork legalities.

- Cash flow to the mortgage backed securities (MBS) / derivatives is drying up so that impacts banks and even pension funds holding them.

- Banks are still in a bad way and it will get worse the longer the housing mess exists.

- And the market is roaring upward still...am I taking crazy pills?

- We're in worse shape now than when this all cracked open in 2007 it seems but people are getting giddy. Bullish sentiment is getting high again.

- When it gets like this...it can change very quickly...you just never know when.

- Good luck.

- This foreclosure thing is bad. Sure, banks did some dodgy things. However, ultimately, those that bought houses they couldn't afford, and then even took out second mortgages, made poor decisions and should realize that.

- JP Morgan provided some interesting data on how slow foreclosures are going. Basically, the time between when foreclosure notices go out, people stop paying mortgages and are eventually evicted they are living rent free for a long time. A couple of examples of state averages:

- Average for all states -- 1 yr 3 months

- Florida -- 1 yr 10 months

- New York -- 2 yrs 2 months

- I guess that makes the rest of us folks saps.

- Below, Producer Price Index shows 4% year over year change for inflation...NOT the "no inflation" the government reports to you. They report without food and energy which happen to be the very things you need to survive and must always buy at whatever price.

- It's a momentum type of market. Continues to go up. However, indicators are getting into areas where I'm just unwilling to risk new buys.

- FED announces new POMO schedule today which takes it into the election. Suspicious? Naw...cuz after that we'll hear about QE2. Right?

- Truth alert...Markets are meant to be free. Free to ebb and flow. But they aren't right now. That is why I am unable, or unwilling, to drink the Kool-Aid. What happens when the propping up stops? Well, we saw it back in May...the QE first round stopped in mid-March.

- I'm leaning toward the defense side because this is stretched. Choose points judiciously. Next resistance areas 1200 and 1220 (April highs).

- But, don't listen to me because Bennie and the Feds are saying all is right with the world. If that's the case...why all the talk of QE2???

- Why don't I believe? Because my personal belief is that true markets will eventually win out over any and all manipulation attempts...for reasons not currently visible.

- I really need to see some normal action...until then, it's max defense.

- Still only trading...it's just the way it is.

- Happy Days are here again!!!

- This market is relentless...won't even take a breath. Like the MAR to APR run...no ebb and flow.

- I guess it proves that the Feds can buy a stock market rally with their POMO cash. And if that's the case, why don't they do it all the time? Heck, we'd all be rich and wouldn't need to worry about unemployment any more...right?

- Besides, the economy is on the verge of roaring back and the housing market has really healed and is ready to go on its own tear again anyday...right?

- This whole monster rally from MAR 09 has been an amazing move. It was released once Congress bludgeoned the Financial Accounting and Standards Board (FASB...they make the accounting rules) and the FEDs started pouring "fuel" into the banks. History...After the Enron mess, FASB moved to require mark to market accounting in order to prevent blow-ups of that sort. In MAR 09, those rules were suspended and mark to model was enabled. So, we're in a spot where Enron potential exists all over the place in our banking system. Doesn't mean there has to be a blow up. But the question is why would you even tolerate the possibility of 2008 again???

- I'm sorry for the sarcasm. None of this makes any sense to me. I suspect I'm not the only one.

- Intraday HFT more than likely. Top chart is a 1 minute plot of NYSE TRIN.

- Just for giggles, the bottom chart is the 1 second plot of the morning's timeframe of TRIN.

- BUY, SELL, BUY, SELL...Hot potato, hot potato.

- Not normal...at all.

- This is frustrating as all get out.

- Hmmm...are the tax cuts the problem? Or is it the spending. Graphic below puts it into perspective. Let's get real folks. I don't care how much wailing and nashing of teeth some folks do to try and convince you that "If we can just recover the Top Earner's Tax Cuts, we can solve our whole deficit problem." Bullshirt...look at the big blue spending bar on the left and now compare the tax cuts for the rich in that tiny red bar on the right.

- What do you think???

- The truth is that those supporting tax hikes want / need that money for one reason...to spend it! If they were serious about balancing the budget, they WOULD NOT have put in the largest entitlement increase since Bush's Medicare Part D....which I railed against, as well, since it was unpaid for.

- The Oligarch's are out of control and must be reigned in...Remember in November...VOTE!!!

- Broke to the upside of the consolidation on a POMO Day. Give Da Boyz cash and they've been putting it to work. It'll be nice to get through these POMO days and see what kind of real buying is there instead of Bennie and the Feds....it clouds things since it could all very well be an illusion. Sure, call me paranoid...no problem.

- Today is the last POMO day...OCT 13th we'll find out if more is going to be scheduled.

- Welcome to earnings season where price action can get wild in individual stocks.

- In that 1165 area I have talked of in the past. Will be interesting to see what happens in this area.

- "Pay no attention to the man behind the curtain"??? This QE stuff is getting outta hand.

- Above is the US 10Yr T Note interest rate. Note that rates actually went up at the QE announcement and then went down when it stopped. The exact opposite of what the Fed said it would do.