skip to main |

skip to sidebar

- Bull Bear battlezone here between 1200 and 1170. Sideways range bound action. Won't know which way she wants to go until we see a break in either direction with follow through.

- Happy Thanksgiving!

- It's Wednesday and that means this holiday shortened week is basically over as far as I'm concerned. So, I'm going to use this very long weekend to give thanks for my many blessings, relax and enjoy family.

- Below, pulling back toward the 50MA as discussed a few days ago. Did have to redraw the trendline since the initial steep one had been broken but the channel seems to look good. Although it did break downside again yesterday...tough to say during this holiday week.

- As indicated 10 NOV, Vet's Day post, the correction is now playing out.

- Market has broken down from the up channel and has fallen into the first congestion area (black line). The 50MA isn't far below either. If this is just a correction there could be some more down but some shorter term indicators have gotten oversold, so may get a little stabilization first.

- Now that the market is getting some flow back, will be watching to see how it moves to determine what may be up. If this turns out to be more than just a correction, could we see a rally back up toward 1197 / 1213 and a fail? Who knows...

- Just watching and trading...all I can do in this Fed POMO world...gotta be nimble! Interesting point though, POMO has been basically daily for the past week and it seems to have lost some of its shine. Is Ben Bernanke losing his grip on the markets?

- Just interesting anomalies? Or thought inducers. Your call.

- I'm a geek! Always find even esoteric things intriguing.

- "Quantitative Easing Explained"...simple and concise 6 minute video exploring QE2. I want you to listen closely, especially, around the 3 minute mark for exactly why this crap is being done again on steroids when it didn't work the first time (QE1)....AND WHAT YOU ARE NOT BEING TOLD!

- Psst....Bank bailouts continue at tax payer expense!!! Yes, it's that simple folks! Only now they can't be shoved through CONgress and the President, so they will be back doored via the FED and the "spread between purchase and re-sale prices" associated with these swaps (the Vig).

- Isn't that nice?!!! It's all about the banks baby! They're still insolvent, the government is still trying to hide it, you're still getting ass raped (sorry, calls 'em like I see's 'em) and you don't even know it or worse don't care. They are counting on you being naive, disinterested, or, worse, just plain ignorant. And ya know what? They seemed to have nailed this one on the head for far too many Americans.

- Remember when Obama said, "I didn't come to Washington to protect a bunch of fat cat bankers"? Well, he is completely full of fecal matter. He's not pulled back TARP, FASB was forced to change mark to market accounting standards (contrary to Sarbanes-Oxley) to make the banks "look" good, his "historical" Financial Regulatory reform was so weak as to be useless and he continues to pump free money into the Primary Broker Dealers (ie, big banks) via QE1 and QE2.

- Wake the fork up America...NOW!

- Write your representatives!!!

- Extra Tidbit: Meet the Robo-signers (ie, burger flips handed a pen and a pile of paperwork) testifying in court on the Massive Mortgage Mess. This is going to eventually blow the banks wide open. The sad thing is that it wasn't the government regulators that brought this to light...it's been a bunch of greedy lawyers...and they'll have job security and good cash flow for many years.

- Great 4 minute video..."I fought for you."

- Market appears to have begun a correction...especially after hours, Cisco disappoints with earnings. Hate when stuff breaks loose after hours...but it's the way the game has been played for awhile now.

- Guides show it as up. Let's see how this plays out.

- New POMO schedule released from the Federal Reserve. Ridiculous...how to operate in a government manipulated market? I'm stymied. None of this makes sense to me so I will continue to trade in and out. All I can personally do comfortably.

- You can check charts in the sidebar.

- Initial press release on Debt Commission due to release results on 3 DEC.

- Below for your consideration....Here is a stunning chart of insider trading activity, courtesy of SentimentTrader. What do Corporate CEO's know that you don't? It's stuff like this that makes me nervous. They can be early as they tend to want to sell into rising markets but you can review the history.

- We voters are watching you....Don't screw it up, knuckleheads!!!

- On a separate note...

- Interesting historical graphic on the Dow Jones Industrial Average below.

- Too few examples to draw any real conclusions but let's look at what it suggests...

- War, Consumer Price Index increases (inflation), war ends, post-war recession, CPI slows or reverses. stocks soar.

- Or, the alternative view...wars cause inflation and long sideways stock performance. So, avoid war when possible.

- Correlation or causation?

- Next question...are we really able to sustain a possible double of the CPI as has occurred in the past?

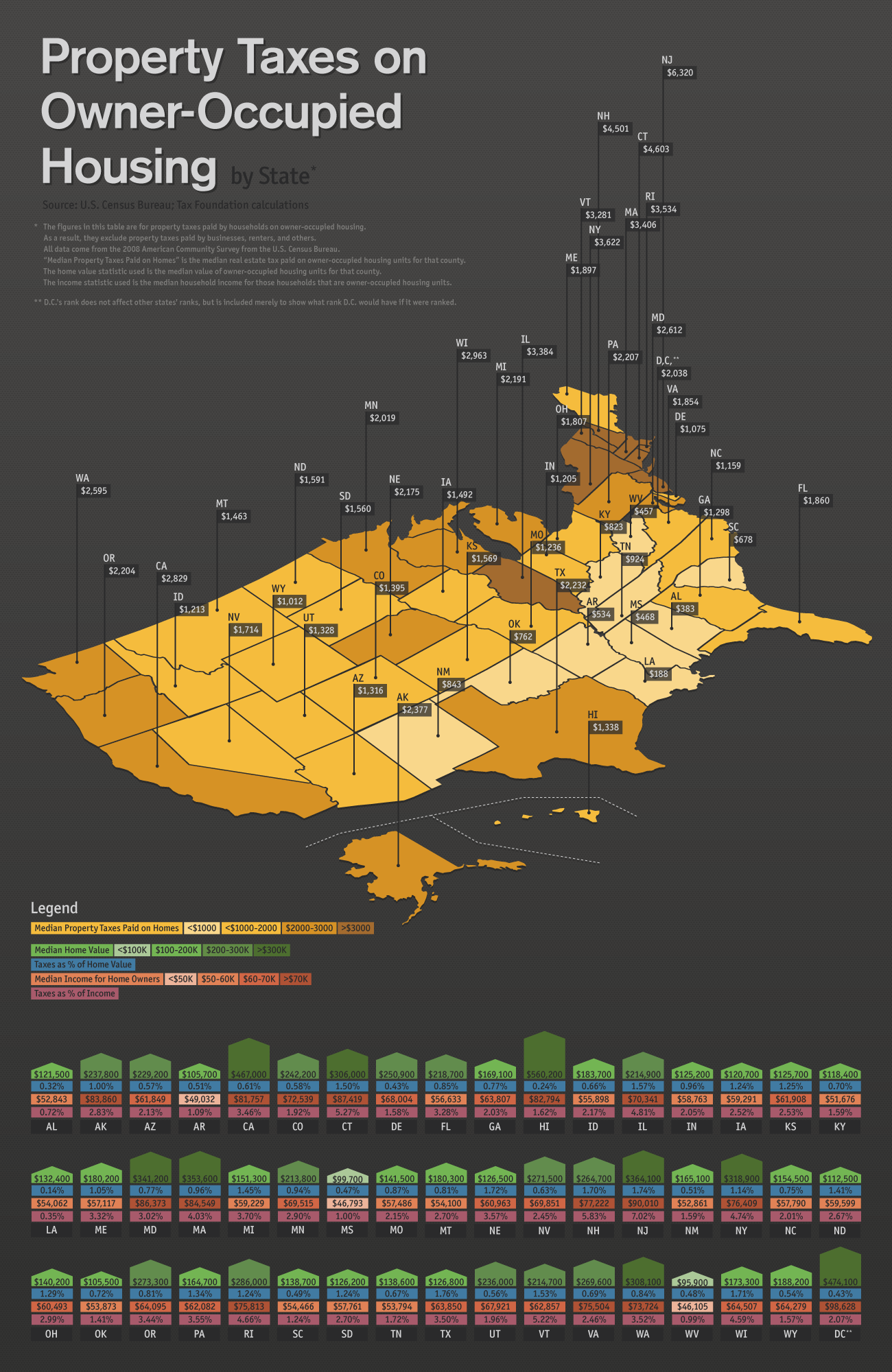

- Interesting national property tax comparison below.

- Historical recession length comparisons below.

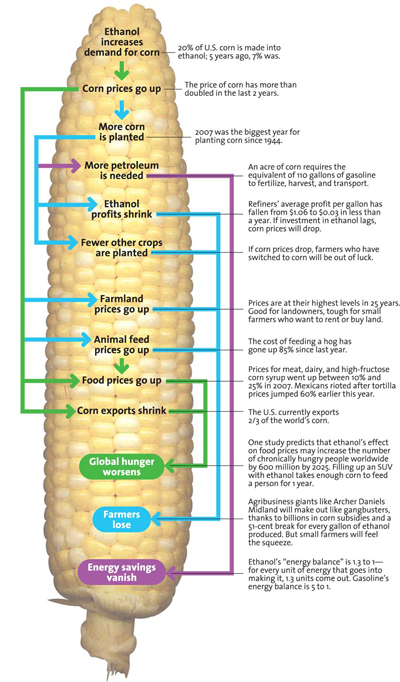

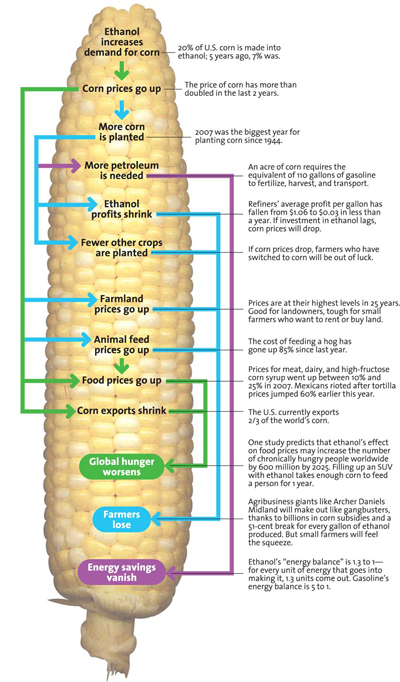

- Ethanol....or the many reasons why burning America's food supply (corn) is stupid!

- Whoa! That was quick...1220. All in one day after diddling around as much as it has been recently. And getting a bit overbought again with RSI deep into the 70's. Compare past price action once you get to the 70's level and it can continue for a bit but you're typically closer to a correction.

- Bested the April highs by a smidge, too.

- I admit it...absolutely unbelievable and extraordinarily difficult to watch this market. I'm befuddled as it hasn't operated in a normal manner or in a manner that I like to work in. That and the fundamentals are confounding and thus I didn't have any conviction in the thought of an intermediate move like we've seen. That forced me to more of a quick trading mentality which isn't appropriate for investors.

- I'm trying to come up with some sound reasoning to develop a perspective from which to operate and, well, I am unable. Government involvement in our marketplace is distorting alot.

- Market is on a multi-Mountain Dew caffeine buzz. But, it is what it is. Up is up. Moving average guides have shown that since early September. Breakout above resistance showed that in mid September.

- Next areas...1220, 1245 is a guess. But, heck, maybe Ben and Da Boyz have their heart set on "to infinity and beyond". Wherever they want it, they sure are in a hurry. Will this be a blow-off?

- We will eventually see a trip back to the 50MA (red) or it will eventually catch up to price when it begins to correct.

- My brain has got me in trading mode since I've been filled with doubt. My problem right now so trading is the only way to go when in that mindset. Still don't like sentiment and the thought of record insider selling with all this hype going on. We are approaching an intermediate top of some kind. What kind? Small correction of this recent up move or something larger will be the question to be answered then.

- Saw this pic and it seemed appropriate to what is going on. It gave me a chuckle.

- This post is dedicated to you Ben Bernanke...

- Background music to start while you go reading the next items...Bennie does his very best Barry White!

- The following is a collection of posts from Karl Denninger whom I happen to agree with regarding the Federal Reserve's decision today regarding QE2...

- Today's Fed announcement analyzed.

- Another hit for the addicts...

- Congresswoman condemns QE2...

- Glenn Beck charges perjury on Bernanke...

- The deception builds...

- Ben Bernanke admits that he's targeting stock prices?

- Today was a watershed moment in our history. You'll notice that I've put forth many discussions recently leading up to QE2 (including the failure of QE1). They're my opinions and, without a doubt, I could be very wrong.

- But...IT'S MONETIZE THE DEBT TIME.........YEAH!!!

- Welcome to a brave new world...we've been solidly thrust into an experiment. I'm not comfortable with either my country, my family and neighbors or myself as a lab rat. Yet, here we are! Find the cheese...or electric shocks!

- Fork in the road time...

- The possible outcomes are two.

- FACT: QE1 failed....no improvement to the economy however all the hot money pumped assets including bonds, stocks and commodities. So, double down....

- FACT: After the Jackson Hole meeting of the Fed Heads in mid-August, the promise of QE2 filled the markets (and the POMO cash) and we've seen stocks burst upward 15% with no decent corrections. Also, we've seen the grains (ie, corn, wheat, oats, etc) jump 40%. Cotton has jumped 50%. And oil, despite inventory levels being at their highest in history, has jumped 20%....$4-5 gas coming? Don't know about you...but these are things that I tend to need to live life daily.

- Sheesh!!! Those moves occurred in 2 months...two!!! No inflation? Ben...are you crazy? Red pill? Blue pill? How far does the rabbit hole go?

- FACT: Producers / manufacturers that use those products will be forced to try to push those price increases through to the consumer (ie, you and I). If they can't, because consumer demand is low, their profit margins will suffer and thus their stock prices will fall.

- OPINION: We are at THE fork in the road. Buckle up....this could be a very wild year ahead of us.

- OPINION (A): If the price push occurs and people lose faith in the US Dollar, then we'll get very high levels of inflation sustained over a period of time. Interested in that? Didn't think so.

- OPINION (B): If we get a brief inflationary spike and it causes folks to hunker down even more, it will severely impact our already struggling consumer economy. It could be the trigger that starts the next leg down. Folks that are rolling off the extended 99 weeks (2 years...used to be 26 weeks) of unemployment benefits will be in max defense mode. We could get an initial spike higher in interest rates due to fear of a falling Dollar which would force housing prices even lower since people buy a monthly mortgage payment and not the house...would make housing less affordable to average potential buyers lowering demand further. People already struggling to make ends meet and the monthly payment could be driven to foreclosure / bankruptcy more quickly...not good for the banks holding these loans. The banks experience higher loan failure rates would require lower lending so that they can meet their legally required reserve ratios. The Mortgage Backed Securities pitched to investors / pension funds blow up since the cash flow that supposedly is backing them dries up. Especially not good for pension funds as the Boomers are hitting retirement age. Etc, etc, etc.

- Do you smell a trap in either direction?

- It's complex...there are so many connections and moving parts in this mess...it's like a Rube Goldberg. Hopelessly complex and when one domino falls it results in a totally unimaginable cascade of unintended consequences.

- So, thanks Ben! I'm having a straight up triple whiskey and hoping that you get it right!

- I fear that you aren't. For example, the elderly who saved their whole lives and were hoping to live off interest income have been totally crushed due to your 0% interest rates...one solid example. Nice, huh!

- So again, I hope you're right....

- Yet I fear that the rest of us will be paying your tab.

- So good luck to you all while Ben takes care of Da Boyz!

- Things I'm really tired of include:

- Robo-calls from politicians and

- All the hype behind QE2....

- Perhaps tomorrow we'll know the outcomes of both and can finally move forward!

- "Home, Home on the Range...where the bulls and bears love to play..."

- Isn't this fun?

- Tomorrow is Election Day...