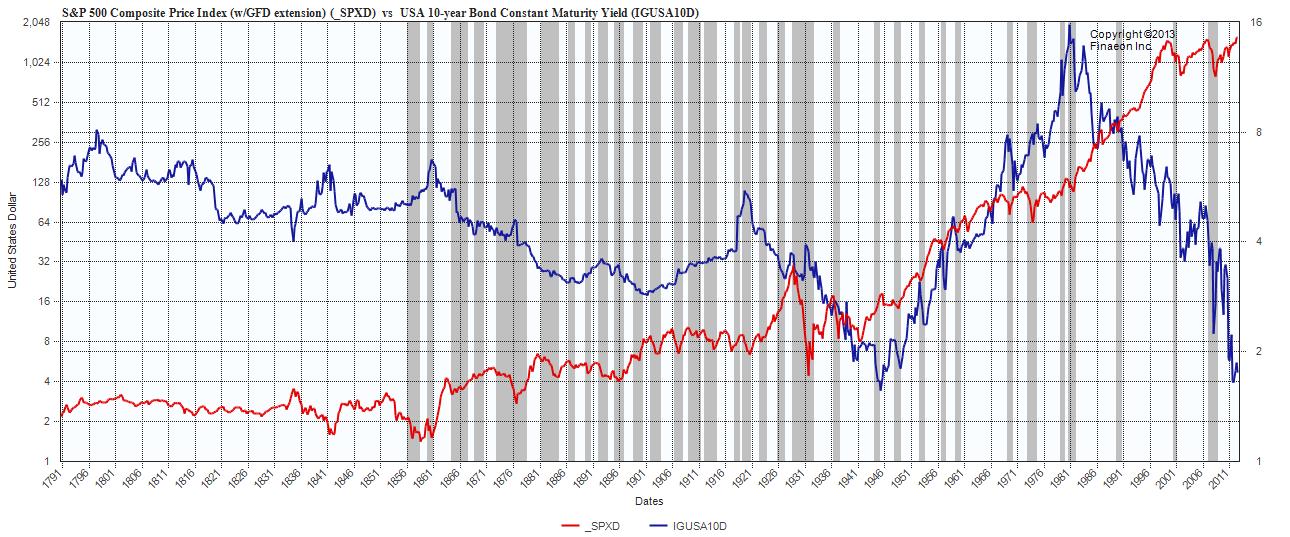

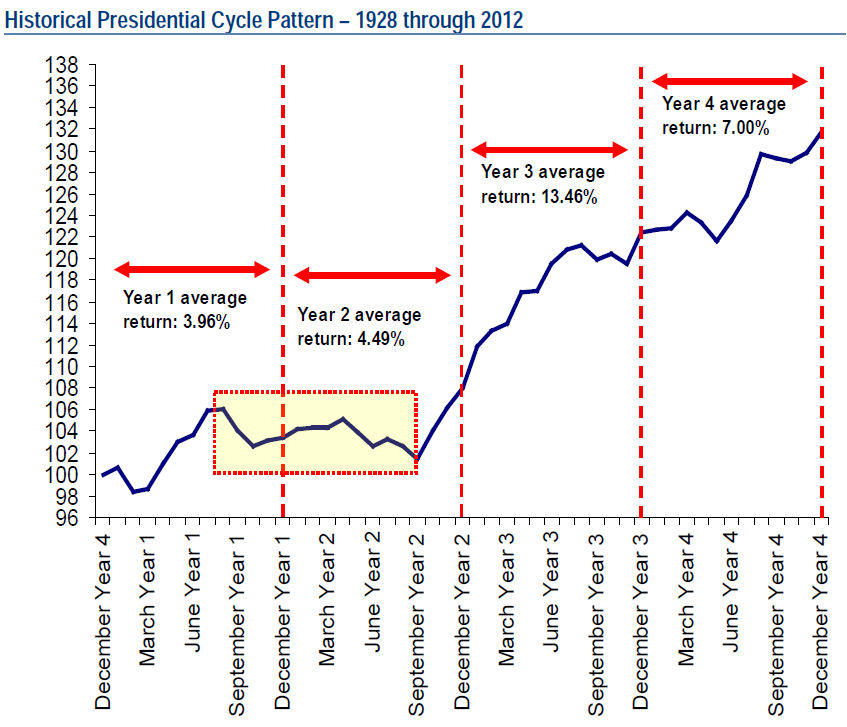

- For those that follow fundamentals...a good representation of the general business cycle.

- Overall, it's reasonable.

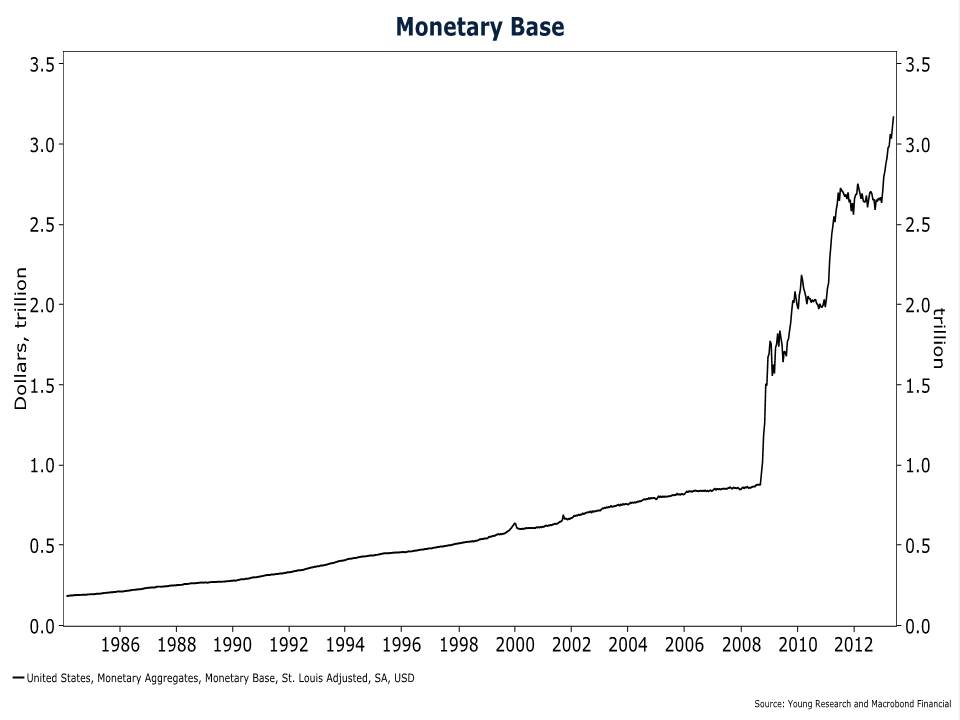

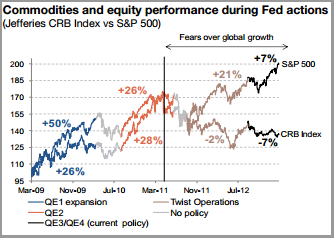

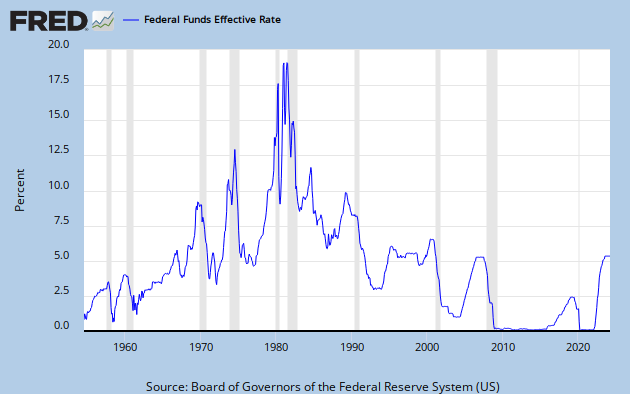

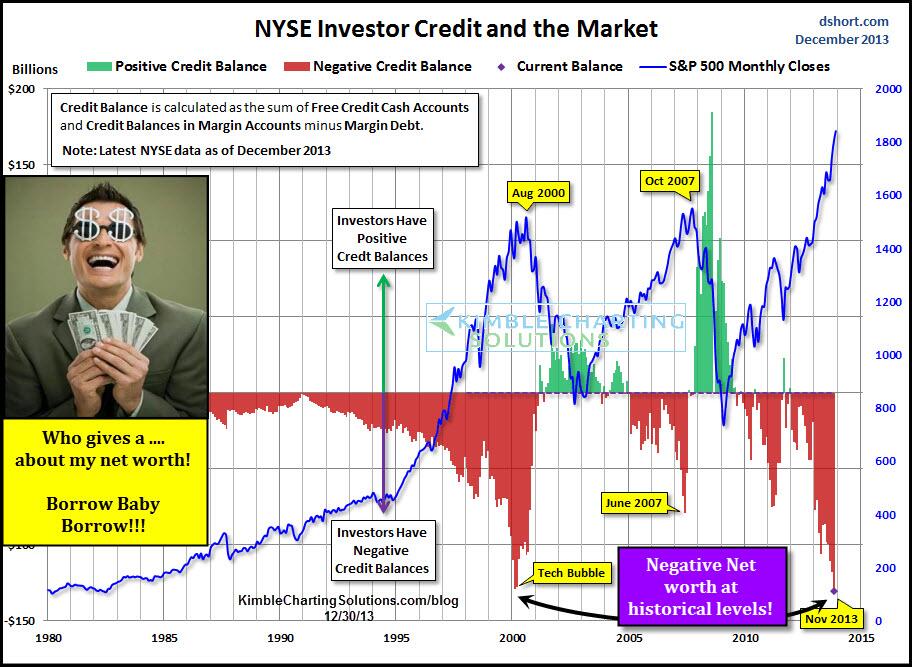

- I wonder how it is being affected by the manipulations of the Federal Reserve's Quantitative Easing.

- Currently, we seem to be somewhere in the Stage 4 (approaching Stage 5 phase)???

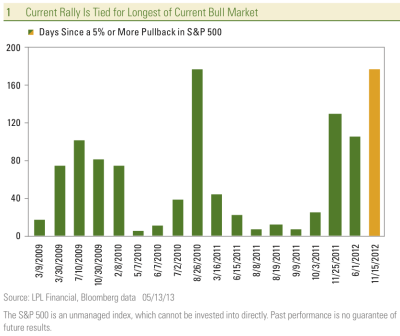

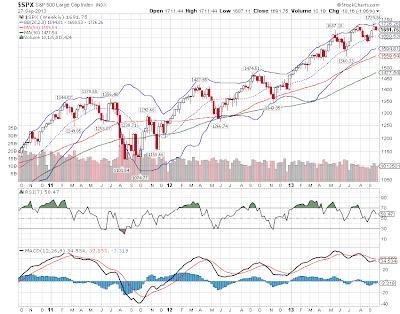

- Trendlines and sentiment readings from previous post are still in play. It's been a slow upward grind which is always a challenging environment.

- Time will tell.

.png)